The charitable deduction limitation for cash contributions to certain public charities and private foundations is increased to 60 from 50 of an individual s agi for the year.

Charitable contributions subject to 10 floor.

The cares act increase these amounts to 25 of taxable income for 2020.

Casualty loss before 10 limitation after 100 floor.

Not in a federally declared disaster area 19 000.

Unreimbursed employee expenses subject to the 2 of agi limitation.

Enter the smaller of line 10 or line 12.

The cares act allows individuals who do not elect to itemize their deductions to take up to a 300 above the line deduction in arriving at.

14 noncash contributions subject to the limit based on 50 of agi.

Multiply line 11 by 0 6.

Contributions made to a non operating private foundation or a donor advised fund daf do not qualify as qualified charitable contributions.

Cash contributions subject to the limit based on 60 of agi if line 10 is zero enter 0 on lines 12 through 14 12.

Qualified contributions are not subject to this limitation.

14 noncash contributions subject to the limit based on 50 of agi.

Qualifying charitable contributions made between october 8 2017 and december 31 2018 to california.

Trusts have the same limitations for investment interest expenses can take real estate tax deductions and have separate deductible items subject to the 2 floor.

Enter the smaller of line 10 or line 12 13 14.

Special rule for california wildfire relief contributions.

Subtract line 13 from line 10.

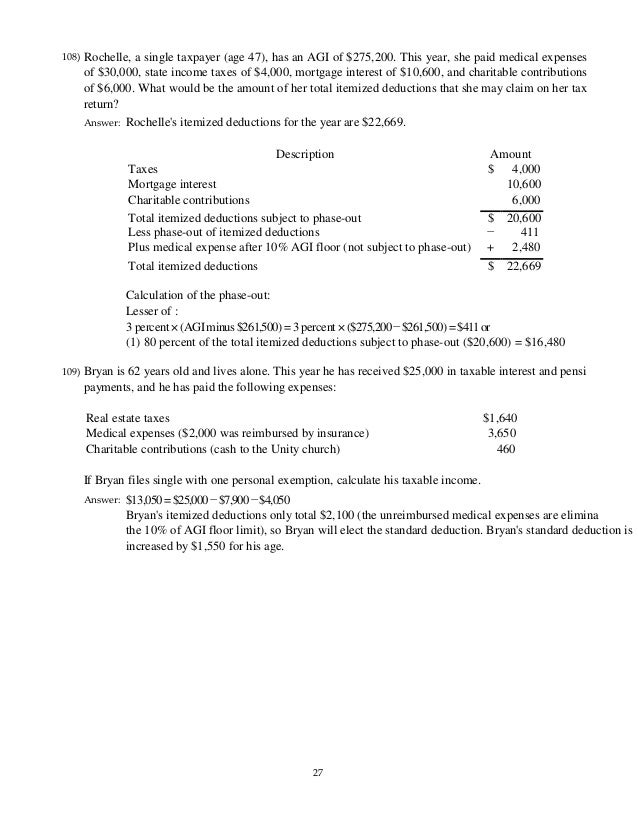

The 100 of agi contribution limit applies only to gifts of cash directly to charities not including family funded private foundations.

Subtract line 13 from line 10.

Under the tcja the annual charitable deduction by a corporation is generally limited to 10 of taxable income while a 15 limit applies to charitable contributions of food.

Allowance of partial above the line charitable contributions.

Cash contributions subject to the limit based on 60 of agi if line 10 is zero enter 0 on lines 12 through 14 12.

Multiply line 11 by 0 6.

Donations in excess of 25 may be deducted in the following five years.